social security tax calculator

So benefit estimates made by the Quick Calculator are rough. Thats what this taxable Social Security benefits calculator is designed to do.

How To Calculate Fica For 2020 Workest

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity to change.

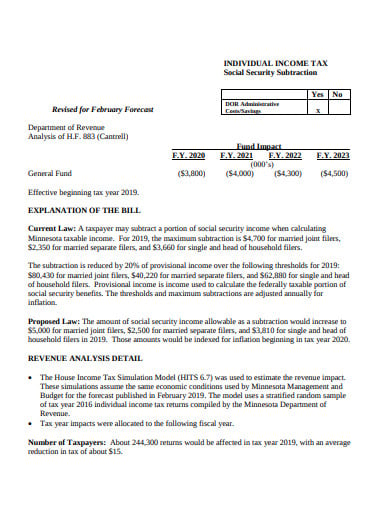

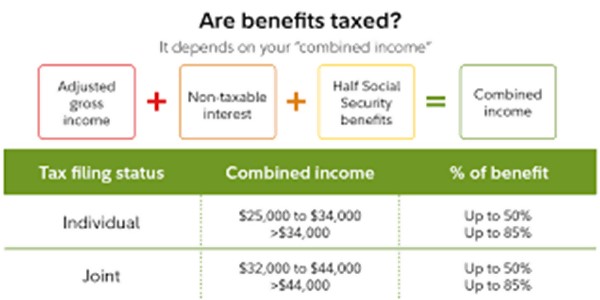

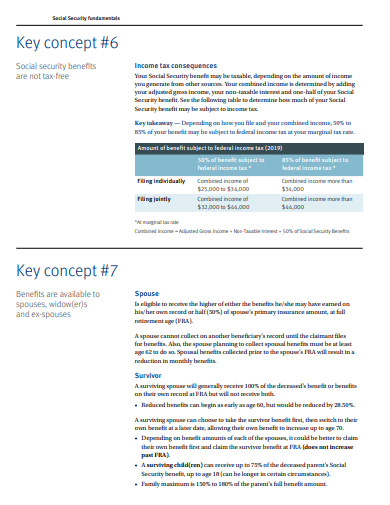

. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Social Security Tax and Withholding Calculator. Social Security Taxes are based on employee wages.

The maximum Social Security benefit changes each year. Based on your projected tax withholding for the year we can also estimate. Give you an estimate of how much youll have to pay in taxes on your monthly benefits.

The Social Security tax rate for both employees and employers is 62 of employee compensation for a total of 124. Enter total annual Social Security SS benefit amount. For 2022 its 4194month for those.

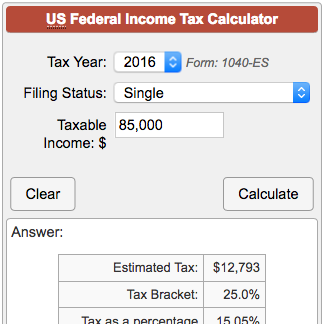

The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Enter your filing status income deductions and credits and we will estimate your total taxes. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your.

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. There are two components of social security. Provisional Income Your.

Social Security taxable benefit calculator. For 2022 that limit is. So benefit estimates made by the Quick Calculator are rough.

Social Security benefits are 100 tax-free when your income is low. Before you use this. If you are under full retirement age for the entire year Social Security deducts 1 from your benefit payments for every 2 you earn above the annual limit.

Box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding. Depending on your income and filing status up to 85 of your Social Security benefit can be taxable. Social Security website provides calculators for various purposes.

The tool has features specially tailored to the unique needs of retirees receiving pension. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. Yes there is a limit to how much you can receive in Social Security benefits.

The calculation can be complicated. For incomes of over 34000 up to 85 of your retirement benefits may be taxed. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which.

Several variables determine the amount of taxable Social Security benefits but as much as 85 of a clients benefit may be taxable. So benefit estimates made by the Quick Calculator are rough. SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits.

The Social Security tax rate for those. How to Calculate Your Social Security Income Taxes. For the purposes of taxation your combined income is defined as the total of your adjusted gross.

Between 25000 and 34000 you may have to pay income tax on. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits. If your Social Security income is taxable the amount you pay will depend on your total combined retirement income.

Enter your expected earnings for 2022. What is your earnings frequency. If youre single a combined income.

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Estimating Taxes In Retirement

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp

Social Security Tax Calculator Are Your Retirement Benefits Taxable Fox Business

Social Security Tax Impact Calculator Bogleheads

What Is Self Employment Tax 2021 22 Rates And Calculator Bench Accounting

How To Calculate Social Security Tax

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Social Security Tax Calculator Are Your Retirement Benefits Taxable Nasdaq

Is Social Security Taxable 2022 Update Smartasset

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Social Security Tax Impact Calculator Bogleheads

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Making Tax Fair Would Guarantee Social Security For Future Generations

Social Security Benefits Do You Have To Pay Tax On Them Somerset Cpas And Advisors

How Much Tax Will I Owe On My Social Security Benefits The Motley Fool